Tuesday, December 23, 2008

Monday, December 22, 2008

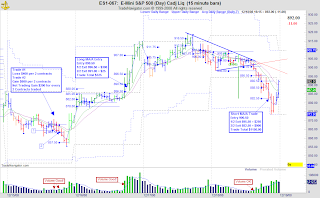

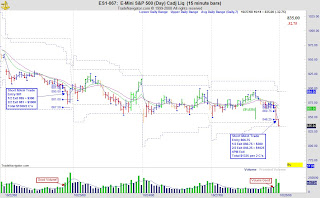

I found this ES chart very interesting notice the Trend Line

Click on chart for a better view of the trend line that contained the downward move until the close of trading today in the ES or the emini S&P.

Click on chart for a better view of the trend line that contained the downward move until the close of trading today in the ES or the emini S&P.I found this very interesting today.

I want everyone to know that I am officially done for the year trading, and will continue my trading on January 5th, 2009 now. If you want details concerning my live trading chat room that is scheduled to commence, then the best way to do this is to sign up for my updates via the form on the right hand side of my blog so that you will be able to receive them.

If you want to read more about me:

www.RockwellTrading.com/about-us

This website has a short bio up on me, and also the trading company that I have decided to be a partner with. Once again, I am completed trading for the year, but I look forward to working with you, if that is something that makes sense to you in the very near future.

In addition, I want to wish you a very Merry Christmas, Happy Hanukkah, Happy Kwanzaa, or whatever you celebrate at this time of year. I would also like to take this time to wish you a Happy New Year.

I have a few year end things that I would like to share with you, but for the most part I have shut it down for the year now.

See You in 2009!

Good Trades,

David AKA Tiger

Saturday, December 20, 2008

With economy in shambles, Congress gets a raise

By Jordy Yager

Posted: 12/17/08 05:41 PM [ET]

A crumbling economy, more than 2 million constituents who have lost their jobs this year, and congressional demands of CEOs to work for free did not convince lawmakers to freeze their own pay.

Instead, they will get a $4,700 pay increase, amounting to an additional $2.5 million that taxpayers will spend on congressional salaries, and watchdog groups are not happy about it.

“As lawmakers make a big show of forcing auto executives to accept just $1 a year in salary, they are quietly raiding the vault for their own personal gain,” said Daniel O’Connell, chairman of The Senior Citizens League (TSCL), a non-partisan group. “This money would be much better spent helping the millions of seniors who are living below the poverty line and struggling to keep their heat on this winter.”

However, at 2.8 percent, the automatic raise that lawmakers receive is only half as large as the 2009 cost of living adjustment of Social Security recipients.

Still, Steve Ellis, vice president of the budget watchdog Taxpayers for Common Sense, said Congress should have taken the rare step of freezing its pay, as lawmakers did in 2000.

“Look at the way the economy is and how most people aren’t counting on a holiday bonus or a pay raise — they’re just happy to have gainful employment,” said Ellis. “But you have the lawmakers who are set up and ready to get their next installment of a pay raise and go happily along their way.”

Member raises are often characterized as examples of wasteful spending, especially when many constituents and businesses in members’ districts are in financial despair.

Rep. Harry Mitchell, a first-term Democrat from Arizona, sponsored legislation earlier this year that would have prevented the automatic pay adjustments from kicking in for members next year. But the bill, which attracted 34 cosponsors, failed to make it out of committee.

“They don’t even go through the front door. They have it set up so that it’s wired so that you actually have to undo the pay raise rather than vote for a pay raise,” Ellis said.

Freezing congressional salaries is hardly a new idea on Capitol Hill.

Lawmakers have floated similar proposals in every year dating back to 1995, and long before that. Though the concept of forgoing a raise has attracted some support from more senior members, it is most popular with freshman lawmakers, who are often most vulnerable.

In 2006, after the Republican-led Senate rejected an increase to the minimum wage, Democrats, who had just come to power in the House with a slew of freshmen, vowed to block their own pay raise until the wage increase was passed. The minimum wage was eventually increased and lawmakers received their automatic pay hike.

In the beginning days of 1789, Congress was paid only $6 a day, which would be about $75 daily by modern standards. But by 1965 members were receiving $30,000 a year, which is the modern equivalent of about $195,000.

Currently the average lawmaker makes $169,300 a year, with leadership making slightly more. House Speaker Nancy Pelosi (D-Calif.) makes $217,400, while the minority and majority leaders in the House and Senate make $188,100.

Ellis said that while freezing the pay increase would be a step in the right direction, it would be better to have it set up so that members would have to take action, and vote, for a pay raise and deal with the consequences, rather than get one automatically.

“It is probably never going to be politically popular to raise Congress’s salary,” he said. “I don’t think you’re going to find taxpayers saying, ‘Yeah I think I should pay my congressman more’.”

Friday, December 19, 2008

''Twas the bailout before Christmas

December 18, 2008

''Twas the bailout before Christmas, and people said with a gasp,

“Hey look, is that a stock market collapse!?”

The Big Three CEOs skulked like rats from their lairs,

And begged, hoping billions soon would be theirs!

The bankers meanwhile nestled snug in their beds,

While taxpayer dollars danced in their heads!

The citizens were stunned, like lemmings in May,

Wondering how much more would be taken away!

The dollar it plunges, the deficit soars,

Investment capital is fleeing our shores!

Illegals pour in, we’re treated like pawns,

We’re told time and again we can’t tend our own lawns!

Down savings, down home price, down 401K,

We “hope” to have “change” left at the end of the day!

And just when we thought our fate hadn’t been sealed,

They sell us a t-bill with a negative yield!

When down on the Senate floor there arose such a blather,

(We’d not heard such hot air since the demise of Dan Rather!)

And to no one’s surprise, we learned in a flash,

They’d voted again to spend more of our cash!

Bush now rides off, he’s made all of us cringe,

Now he’s spending our money like a Dem on a binge!

Printing more money and priming the pump,

The Fat Cats are certain of remaining quite plump!

"On Obama! On Biden! On Pelosi and Ried,

From fiscal restraint, you now have been freed!

Raise taxes, raise rules, regulations and fees,

Keep it up ‘til the last oil company flees!"

Tax coal, tax carbon, bid Hummers adieu,

Tax natural gas, electricity… hell, oxygen too!

Away Iraq and Iran and Guantanamo Bay,

“Please some one, just make it all go away!”

We just want our Hi-Def and “Dancing with Stars”,

We buy iPods and Wii’s, heck who needs new cars?!

We trust for some reason those running our government

Never mind who got us in this predicament!

This trust is quite odd, it defies all good reason

For they become more corrupt, as they develop more “season”!

But we just keep electing them, though we’re never sure which

Will defiantly stand as our next Rod Blagovich!

Way back when we were free to “speak” and “believe”

We’ve been shoved overboard now with one mighty heave!

Yes, the times there are changin’, or so it would seem,

Your government is now one big Ponzi scheme!

The old days they are over, yes this much is clear

The politicians'' response: “Send your money here!”

So don’t look back even once, just embrace the new way.

Perhaps buy a Senate seat off of eBay!

Then when all seemed lost, came a man with a sack,

His eye’s how they shifted, like coal they were black!

His bag it reads “TARP,” he doles out cash where most bleak,

‘Til he changes his mind again early next week!

He moved away from the light, not unlike a thief,

“We’re about to get screwed” was our common belief!

But I heard him exclaim, as we shouted our beef,

"Happy Bailout to some!” Our reply, “Oh Good Grief!"

Thursday, December 18, 2008

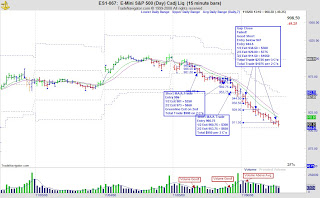

Thursday Day Trading: ES Trade $1150 per 2 contracts

Click on chart for comments on the ES Market Trade.

Click on chart for comments on the ES Market Trade.Finally, the ES decided to play ball. This was a trade that took all week to get a nice move, but at last on Thursday we had a nice downward move as the bonds made historic highs this week.

Good Trades,

David AKA Tiger

P.S. You can see my picture and bio up on the Rockwell Trading website now.

Go to About Us at: www.RockwellTrading.com/about-us

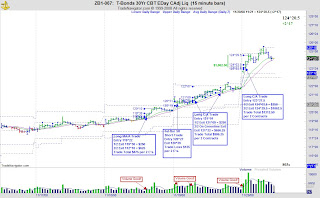

Thursday Day Trading: G6E Trade with Bonds at Historic Highs $1375 on 2 Contracts

Click on chart for comments on the G6E Market trade.

Click on chart for comments on the G6E Market trade.A good alternative to the ZB is to trade the G6E as we are at historic highs in the bonds, and being uncomfortable trading the upside in the bonds now.

This was a trade that I made in the G6E this morning for a nice profit. On every 2 contracts this one earned $1,375.00.

Good Trades,

David AKA Tiger

Wednesday, December 17, 2008

Wednesday Day Trading: ES Tough trading this week

Click on chart for a larger picture of today's price action. This week once again proves how tough it is to trade the week of Triple Witch. That is, with options expiring, futures expiring, etc for the month of December.

Click on chart for a larger picture of today's price action. This week once again proves how tough it is to trade the week of Triple Witch. That is, with options expiring, futures expiring, etc for the month of December.I have come to a conclusion that a day trader should have eight weeks off a year now. Two in the middle of Summer, Two around XMAS and New Year's, and each week of the triple witch weeks. What I mean is the 3rd week of the month that falls in the week of the current ES contract. The months that this effects is March, June, September, and December.

December has been a tough month overall to trade. Tomorrow being Thursday will be my last trading day of the year, and I will not commence trading until after a nice 2 week break. My trading will continue once again on the 5th of January, 2009.

This week I will put together or early next week a blog post with the trading net gains up to this point in time from when I started the blog back in May. I have some real good news to report into next year, but we will wait until it is official before I say more about it here on blogger.com.

In any case, this week of trading has been tough in both markets that I like to trade, ES and ZB. There has been some real good move in the G6E recently around the FED RATE cut decision and the European banks.

Next year, I plan on occasion adding a G6E trade to my current trading plan. I am looking forward to the time off to do some much needed back testing, and planning for the next year. With this being said, we will see what the market is willing to give tomorrow, and remember to "TRADE what you SEE and NOT what you THINK!"

Good Trades,

David AKA Tiger

P.S. The Pilot Trading Chat Room has been a lot of fun over this week. I look forward to continuing this room in 2009.

Tuesday, December 16, 2008

FOMC Rate Cuts Bolster Optimism

FOMC Rate Cuts Bolster Optimism

Dow +359.61 at 8924.14, Nasdaq +81.55 at 1589.89, S&P +44.61 at 913.18

[BRIEFING.COM] The Federal Open Market Committee's decision to slash key lending rates and make a commitment to remedy the ailing U.S. economy bolstered investor optimism and sent stocks sharply higher. The major indices traded in positive ground for the entire session and finished just off their session highs.

The FOMC was expected to slash its fed funds target rate by 50 basis points Tuesday, which would have brought the overnight borrowing rate banks charge one another down to 0.50%. Instead, the FOMC stated it is targeting a fed funds rate ranging from 0.00% to 0.25%, though the effective fed funds rate was already within this range ahead of the decision.

The decision to make the cut was unanimous and marks the first time the target rate has been below 1.00% in 50 years.

The highly stimulative rate is intended to help the economy get on track toward growth. The FOMC stated that data indicate deteriorating labor conditions and declining consumer spending, business investment, and industrial production, and the outlook for economic activity has weakened further. However, the FOMC acknowledged it will essentially employ all available tools to promote sustainable economic growth and help relieve strains in the financial system.

The U.S. dollar dropped precipitously after the FOMC made its statements. A weak economy and low interest rates hardly bode well for the strength of the currency. In turn, the Dollar Index fell 1.9%.

Despite the struggles of the economy and the financial system, financials (+11.3%) outperformed for virtually the entire session. The sector's advance came even though Goldman Sachs (GS 76.00, +9.54) posted a larger-than-expected quarterly loss, and had its credit rating downgraded to A1 by Moody's. Investors had been long expecting a loss, sending shares lower in each of the five preceding sessions.

Best Buy (BBY 27.68, +4.21) helped contributed to early-morning optimism by issuing better-than-expected earnings per share results and in-line guidance for 2009.

General Electric (GE 17.92, +0.97) caught a bid after it reaffirmed its outlook for the fourth quarter and fiscal 2008, though it said it will no longer provide quarterly guidance. GE also reiterated its dividend, which has been a point of concern for many investors.

Oil prices have also been in focus with OPEC meeting tomorrow. A cut of approximately 2 million barrels per day is expected, but crude futures for January delivery shed $0.96, or 2.2%, to settle in at $43.55 per barrel. Crude futures had been up as much as 4.5%, but energy traders appear to have fully digested the prospect of a production cut.

In addition to OPEC's decision, energy traders will also contend with the latest inventory data from the Department of Energy, which is due tomorrow morning.

Despite the drop in oil, other commodities advanced. Precious metals found favor again as February gold and March silver advanced. Gold added $6.20 to trade at $842.70 per ounce, while silver added $0.085 to hit $10.705 per ounce.

November CPI dropped 1.7% month-over-month and pulled the year-over-year increase in CPI down to just 1.1%. Both rates were below expectations. The core rate was flat in November and follows a 0.1% decrease in October. The downtrend in CPI has a negative side as it reflects weak economic demand, but there are also clearly benefits in terms of increasing the value of financial instruments.

Housing starts data for November declined 18.9% from the prior month to an annualized rate of 625,000 units, which was below the consensus of 736,000 and 47% below the year-ago level. The November decline is the largest drop since March 1984.

Building permits, meanwhile, declined 15.6% to a seasonally adjusted annual rate of 616,000. That was also below the consensus of 700,000.

..Nasdaq 100 +5.2%. ..S&P Midcap 400 +6.1%. ..Russell 2000 +6.7%.

Tuesday Day Trading: ES Trade after FOMC Rate Cute Announcement

Click on chart for comments on the ES market trade.

Click on chart for comments on the ES market trade.This was a very close trade that I was almost able to stay in for the full ride to 907 today. But the market came back to my protective profit stop of 891 after hitting my first profit target of 896.50.

This was one of those days where simply allowing yourself to take what the market was giving and you end in the winner's circle. This week has been a little tougher to trade as we approach year end and less and less trader's in the market.

There was a lot of action today after the release of the FOMC Rate Cut, before that a lot of grinding in the market for the most part. Today the wise decision was to simply take the morning off and await for the FOMC meeting to announce the rate cut decision, and then make your trade based on that information.

Good Trades,

David AKA Tiger

Monday, December 15, 2008

Monday Day Trading: ZB Trades

Saturday, December 13, 2008

Thursday, December 11, 2008

Thursday Day Trading: ES Trades

Thursday Day Trading: ZB Trades

Wednesday, December 10, 2008

Tuesday, December 9, 2008

Saturday, December 6, 2008

Friday, December 5, 2008

Stocks Surge Despite Abysmal Jobs Data

Stocks Surge Despite Abysmal Jobs Data

Dow +259.18 at 8635.42, Nasdaq +63.75 at 1509.31, S&P +30.85 at 876.07

[BRIEFING.COM] Despite some of the worst jobs data in decades, stocks managed to finish the session with impressive gains after reversing early losses.

From its session low to its session high, the stock market moved from a loss of 3.2% to a gain of 4.1%. It closed with a gain of 3.7%. Stocks finished every session this week with a gain or loss of at least 2.5%. It has been six months since the stock market finished a week without closing at least 1.0% higher or lower in any of the week's sessions.

Stocks fell into an early funk as participants chewed on a 533,000 drop in November nonfarm payrolls, which is far worse than the 335,000 drop that was expected. November manufacturing payrolls declined 85,000, which was actually less than the 100,000 decline that was widely expected. The unemployment rate, now at 6.7%, is the highest in roughly 15 years. The elevated unemployment rate comes as companies lay off workers as part of an attempt to shave expenses amid stiffening economic headwinds.

Recognition of such stiff economic challenges prompted selling in commodities. The CRB Commodity Index dropped roughly 4.3%, while oil dropped around 6.0% to close just above $41 per barrel. Oil's drop took it to its lowest closing level in four years.

Oil's slide weighed on the energy sector for much of the session. The sector traded with a loss of as much as 5.8%. However, broad-based buying pulled the sector into the green, helping it finish with a 1.3% gain.

The broad-based buying effort followed gains in the financial sector, which consistently outperformed the other sectors throughout the session. Financials closed 8.6% higher, led by multiline insurers (+17.5%), like Hartford Financial (HIG 14.59, +7.38). Hartford's share price more than doubled after the company issued upside guidance for fiscal 2008. Despite the massive gain, HIG is still down 85% from its 52-week high.

Elsewhere in the financial sector, the Justice Department said the Treasury is legally bound to inject capital into government-sponsored enterprises, according to Dow Jones. On a related note, Reuters reports the Federal Reserve bought $5 billion in debt from Fannie Mae (FNM 0.87, +0.00), Freddie Mac (FRE 0.86, -0.02), and FHBL.

Executives of the Big Three automakers have been making their own case for government funding. General Motors (GM 4.08, -0.03), Ford (F 2.72, +0.06), and Chrysler are asking Congress for billions to stave off bankruptcy. According to The Wall Street Journal, Chrysler has already hired legal firm Jones Day to provide a comprehensive analysis of the options available to the automaker.

Congressional officials continue to discuss the necessary checks and balances of providing the automakers with taxpayers' funds, making the likelihood of a speedy, clear plan uncertain.

Despite ongoing uncertainty surrounding automakers and the broader economy, stock investors successfully put together a solid rebound Friday, helping soften the week's downturn. The stock market finished the week with a 2.3% decline. That prompted bond investors to take some profits, sending the 10-year Treasury Note down around 48 ticks and pushing its yield to 2.71%. In the prior session the Note's yield fell to around 2.54%, which is its lowest level in decades.

..Nasdaq 100 +4.4%. ..S&P Midcap 400 +4.8%. ..Russell 2000 +4.9%.

Thursday, December 4, 2008

Thursday Day Trading: ES Trade $1,050.00 per 2 contracts

Click on chart for comments on the ES Market trade.

Click on chart for comments on the ES Market trade.Today was an interesting day of basically sitting on your hands and waiting for the market to do anything at all. There was a lot of talking go on between the 3 Big Automakers, and Fed Chairman Bernanke speaking.

My basic plan of attack was not to look at the market for a trading opportunity until the earliest Bernanke would be speaking. I have noticed that in a lot of cases this is a wise decision in the present market conditions that we are in.

In addition, the big 3 autos were on the main stage today telling us all of their problems and why they need money to support their lifestyles and big golden parachute bonus packages ... :-)

Seriously, I am still waiting on my bailout package. Here is what I think we should do for all AMERICAN CITIZENS. We should have a get out of FREE jail card like in the monopoly game, and we should be able to be forgiven all our debts except for our house mortgage.

You want to jump start the economy, then give the buyers the ability to do it again, and when we get in this predictament again. Then the government simply forgives all our debt again. This way we can run just like the government.

In addition, we should all have access to our own personal money tree, and printing press that we can request funds from the FED anytime we want to make a purchase, and then leave them with the bill, and let good old Uncle Sam take care of this for us.

I figure since they are giving away money in the tune of billions, then we as Americans should be entitled to our very own guarateed debt free bailout. So who's with me?

:-)

Good Trades,

David AKA Tiger

Wednesday, December 3, 2008

Wednesday Day Trading: ES $1,250.00 on 2 Contracts today

Click on chart for comments on the ES Market trade.

Click on chart for comments on the ES Market trade.Here is a perfect example of momentum carrying a trade to profit targets. On my profit protective stop placement was as follows. First target was at 848, this was a tough one to take out as yesterday there was some resistance at this level.

I also wanted to see if we could push through the high of yesterday, and then determine how it would react at this point in time. It really never looked back so on the second contract I first moved to 848, then to 852, which is 10 points from my entry at 842.

Volume was above average volume and touching the moving average. This is a riskier trade to take in my humble opinion, but one that I will on occasion take a shot at because of momentum of the trade itself.

In any case, I was rewarded by my 2nd profit target of 861, which was below the Upper ADR by a couple of points on the morning trade.

I did not participate in the afternoon trading on the ES, as I really did not see any valid opportunities to enter into a trade with my trading method. All in all, a very nice trending day today.

ZB Trades netted $750.00 (I was 2 for 3 in the ZB today)

ES Trade netted $1,250.00

Trade Total $2,000.00 for every 2 contracts today. Another one of those $10,000 days trading 10 contracts per entry today to put it into perspective on a medium sized account.

Good Trades,

David AKA Tiger

Wednesday Day Trading: ZB $1,000 on 2 Entries

Click on chart for comments on the ZB Market trade.

Click on chart for comments on the ZB Market trade.This was one of those days where we go down and then back up in the bonds. I was reaching for the ADR (Average Daily Range) on both of the trades, but on a pullback was taken out at my original target of 16 tics each time today.

The afternoon was a little more trickier of a trade, but we went into consolidation for a few bars, and so I got out at my price. This was one of those ones that it could have went down to my entry so I decided to get while the getting is good.

I personally like to see momentum drive a trade quickly to a target as shown in the next chart and trade in the ES today.

Good Trades,

David AKA Tiger

Tuesday, December 2, 2008

December 2008 Book Recommendation

This was a very good book to read. One of my other passions outside trading is reading. I have always enjoyed history and self development books. This book has them both in the same book.

Good Trades,

David AKA Tiger

Monday, December 1, 2008

Monday Day Trading: ZB Long Trade $937.50 per 2 Contracts

Today the wise choice was to stay out of the market and wait for the talking heads to stop talking. By this I mean, that is waiting for Bernanke to release his report and the market to react to it.

Looks like today the charts showed that the market wanted to go up. This is a perfect example of using a report (red) and watching for volume to be GREEN, then getting into the trade and seeing where it will take you.

My exit was a little above the high of that bar, and when the market decided to retrace it took me out. I didn't not want to give up gains so I did not follow the greenline on this trade today, but my first protective stop point was at my 1/2 exit profit area.

Then I moved it up accordingly to capture some more profit.

Good Trades,

David AKA Tiger

Tuesday, November 25, 2008

Monday, November 24, 2008

Monday Day Trading: ES Long Trade $1050 per 2 Contracts

Click on chart for comments of the ES Market trade.

Click on chart for comments of the ES Market trade.Trade Total $1050.00 per every 2 contracts. This was a day where being patient, just like a good fisher paid late in the day. My decision making process was not to trade the morning due to President Bush and President Elect Obama speaking today. I wanted to see what all of this talking would do to the market.

Before this trade, there was another opportunity to make a little money, but I am not showing this trade. The best trade of the day was definitely the ES trade that I made late in the trading day.

Tuesday looks to be the last day I will be considering a trade for the month of November. More importantly, I will be looking for an entry early since there is some "red" reports at 8:30AM Eastern time. There is also another red report at 10AM Eastern time. So this is the time frames that I will be looking for a trading opportunity.

Let me make this clear, I am looking for an A+ trading opportunity, and if I don't get what I am looking for, then I will stay on the sidelines and call it a month. In any case, just wanted to share some of my thoughts for tomorrow as I am planning out my day.

Good Trades,

David AKA Tiger

Saturday, November 22, 2008

Thursday, November 20, 2008

Stocks Post Record Losses (Briefing.com)

Stocks Post Record Losses

Dow -444.99 at 7552.29, Nasdaq -70.30 at 1316.12, S&P -54.14 at 752.44

[BRIEFING.COM] Stocks took out new bear market lows in another volatile session Thursday. News of continued weakness in labor markets underscored ongoing economic concerns while a lack of leadership gave investors little reason to turn about-face.

The latest jobless data ensure an 11th consecutive decline in monthly nonfarm payrolls. Initial jobless claims for the week ended Nov. 15 jumped 27,000 to 542,000. That took the 4-week moving average to 506,500 from 490,750. Continuing claims increased to 4.01 million from 3.90 million.

Mounting jobless claims continue to reflect a downbeat mood among businesses. Layoffs have been on the rise as many businesses look to cut expenses and regain footing despite tenuous economic conditions.

Selling pressure took the S&P 500 down to 747.78 late in the session, which marked the lowest intraday trading level since 1997. All three of the major indices registered new closing lows.

Several marquee stocks also took out record lows this session. General Electric (GE 12.88, -1.57) dropped to its lowest point in more than a decade. A Dow Jones report indicated the company is not seeking equity investments from sovereign wealth funds, which countered earlier reports. Given GE's depressed stock price, shares now carry a dividend yield of almost 10%.

Citigroup (C 4.71, -1.69) shed a quarter of its market cap, despite word that Saudi Prince Alwaleed plans to boost his stake in the financial giant to 5% from under 4%.

Weakness in the financial sector was widespread. The sector closed 10.5% lower; it is now down 68% this year.

Energy posted the largest decline of the session, though. It shed 11.2% and is now down 46% year-to-date.

The steep declines in energy followed losses in crude oil prices. Crude futures fell below $49 per barrel to reach their lowest point in more than three years. The commodity finished the session near its lows.

Uncertainty, which is an enemy of the stock market, continues to surround auto makers. While some reports indicate senators have reached a bipartisan auto aid agreement with wide support, the likelihood that a bill is approved and passed in the immediate future could be slim. One senator said an auto industry bailout would use existing $25 billion in loans.

Both Ford Motor Company (F 1.39, +0.13) and General Motors (GM 2.88, +0.09) advanced on the news. However, Standard & Poors lowered its rating on Ford Motor (F 1.45, +0.19) to CCC+ from B-, but removed it from CreditWatch.

Hope that auto makers would receive a bailout helped stocks climb to strong gains midsession. The S&P 500 was actually up 1.7% midday. However, stocks turned lower as the plan became muddled and no leader emerged to provide support.

As uncertainty and unease mounted around stocks, government Treasuries caught a strong bid. The benchmark 10-year Note surged 91 ticks and is now yielding just under 3.0%.

..Nasdaq 100 -4.7%. ..S&P Midcap 400 -7.8%. ..Russell 2000 -6.6%.

Thursday Day Trading: ZB Long Trade $1312.50 per 2 Contracts

Click on chart for comments on the ZB Market Long Trade.

Click on chart for comments on the ZB Market Long Trade.Entry was after the 8:30AM Eastern time Unemployment Claims RED report. My entry time was at 8:35AM Eastern time this morning.

Entry 123^27.5

1/2 Exit at 124^03.5 = $250

2/2 Exit at 124^29.5 = $1062.50

Trade Total $1,312.50 for every 2 contracts traded.

Yesterday, the same type of trade did not work out, but today it did and went on to reach the Upper Average Daily Range. Nice trade today. This will do it for my week of trading, and I want to wish you all the a good weekend.

Important Note: Trading next week during Thanksgiving tends to be a light trading week. My trading plan has me perhaps looking for a trade on Monday or Tuesday. With that being said, next week has proven to be a light week, and I will be only looking for the very best setups, if any trading at all.

Good Trades,

David AKA Tiger

Wednesday, November 19, 2008

Wednesday Day Trading: ZB 1st Bar SR and Long Trade

Click on chart for comments on the ZB Market trades.

Click on chart for comments on the ZB Market trades.My first entry was at 8:35AM Eastern time, and was not a winning trade. This trade lost $250 for every 2 contracts traded, according to the stop loss. Although, I handled the trade differently in my actual trading taking a loss for less money, but for example we will leave it as is to show you how being patient and disciplined will win the day.

On my second entry, it came at 10:20AM Eastern time at 121^01. My trading plan had me take off my first contract at plus 16 tics or 121^09 for a gain of $250. My second contract eventually caught up with the greenline strategy and the protective stop was hit at 121^22 for a gain of $656.25 for the second contract.

Today's Trading:

1. Loss of $250

2. Win of $906.25

Net Gain: $656.25

Good Trades,

David AKA Tiger

P.S. This happens more than you would think. That is you start your trading in the loss column. The new trader like I used to be at one point in time, and if I am not careful even today, will get their blood boiling on a loss, and do stupid things trying to get the money back. Just like in a casino, always remember the HOUSE has the EDGE. Your only defense that you have and strategy is to remain the following:

1. Patient

2. Disciplined

3. Self-Controlled

4. Faithful

5. Confident

Keep this in mind the next time you get the blood boiling and you put on your revenge hat to make the money back. You are falling into the casino trap of losing it all and more!!

Tuesday, November 18, 2008

Monday, November 17, 2008

Saturday, November 8, 2008

Thursday, November 6, 2008

Thursday Day Trading: ES Short Trade $2725 on 3 Contracts

Click on chart for comments on ES market trade.

Click on chart for comments on ES market trade.ZB $1,125.00 on 2 contracts

ES $1,075.00 on 2 contracts

ES $2,725.00 on 3 contracts

Total On Trade = $3,850.50 (ES and ZB combined today)

Ok, this is my last trade until the week of the 17th of November. I am planning on putting together a video for tomorrow or on Saturday. I have a lot of things to get down before Winter sets in so I will be taking care of all that next week.

Be careful out there ... it has been a lot of fun pulling in money like coming off a tree lately. But I have a feeling that things will eventually settle down at some point. When? Who really knows, but for now looks like the market wants to test the lows of October 10th. We will see if it is a valid low, or if the market wants to go lower.

In all things, TRADE what you SEE, not WHAT you THINK!

Good Trades,

David AKA Tiger

Good Trades,

David AKA Tiger

Video of the Week: Here is to 99 Woodstock!

Kid Rock awesome concert in 1999 at Woodstock.

I felt like a little rock and roll this week.

Good Trades,

David AKA Tiger

Thursday Day Trading: ZB Short Trade

Click on chart for comments on the ZB market trade.

Click on chart for comments on the ZB market trade.$1125.00 per 2 contracts today.

Entry 116^16.5

1/2 Exit 116^08.5 = $250

2/2 Exit 115^20.5 = $875

In addition, I am still short in the ES today. It is turning into a really good trade. I am looking for a retest of the 900 level in the S&P today. My profit target on my last contract is 908.50. This last trade is following on the greenline strategy exit. I was able to pull one off at 938.50, and the second one off at 929.00.

I am still long ONE contract.

Good Trades,

David AKA Tiger

Wednesday, November 5, 2008

Wednesday Day Trading: ES Short Trade Part II

Wednesday Day Trading: ES Short Trade $900 on 2 Contracts

Great Video on the Election!

Agree totally with this video! Why were news stations across America last night reporting WINS based on ZERO percent of the VOTE in! The EXIT POLLS interviews should be OUTLAWED!

In any case, we now know Obama was a big winner last night, but what the media did on this election was SHAMEFUL and DISRESPECTFUL!

Now back to trading and God BLESS America and our New President Barrack Obama.

Good Trades,

David AKA Tiger

Friday, October 31, 2008

October Results are Impressive $42,512.50

Total Gain on the Month Day Trading: $42,512.50

Total Gain on the Month Day Trading: $42,512.50Year to Date Gain: $50,275.00

Plus October 2008: $42,512.50

Total Gain on Trading: $92,787.50

This is utilizing between a total of 2 or 3 contracts mainly in 2 markets, that is the ES and the ZB markets. ES stands for the eMini S&P, and the ZB stands for the 30 Year US Treasury Market.

ZB tics at $15.625 per tic.

ES tics at $12.50 per tic.

With this being said, October 2008 was a historic month, and most likely will be a very long time that this trading method will duplicate the total amount traded using either 2 or 3 contracts at a time in the market.

Before all of this craziness in the market, the average month was in the range of $5,000 to $8,000 per month. I am still in complete amazement of how well the trading method has worked and continues to work week in and week out.

What I am not is a person that understands how best to market myself, or another way of saying this is I am not a person that really wants all kinds of attention. But with this being said, I am still searching for the right fit and I am open to suggestions on how best to not only help you, but help myself in the process.

Some of the ideas that I have toyed with:

1. Write a Book or E Book or both

2. Live Chat Room Web Conferencing (3 to 4 days a week)

3. Go Private and Trade for Profit with a few individuals

4. Develop KnightCapitalManagement.com or DayTradingKnight.com or both

5. Go with a Company that has the support tools, and I simply fit myself in and get paid for my time and efforts

These are the thoughts that come off right on the top of my head. As in all things, I am open to suggestions and advice, so please feel free to get in contact with me. I know where I am strong, and I know where I am weak. Where I am obviously strong is trading and making money, but all the other stuff is a mystery to me.

Well, these are my thoughts and my feelings as I lay them out on this blog. My honest opinion is I am sitting on a gold mine, or an ATM, and I have my own personal money tree right in my backyard.

I want to wish you all the best in your trading, and I mean it when I say, if I can be of assistance to you and your trading just let me know. I promise to get back to all emails that are sent to me.

Good Trades,

David AKA Tiger

Wednesday, October 29, 2008

Video of the Week: Will Ferrell as George Bush SNL

Get out and vote!

May the best man win.

Good Trades and God Bless America,

David AKA Tiger

Tuesday, October 28, 2008

Late Session Rally Lifts S&P 500 11%

Late Session Rally Lifts S&P 500 11%

Dow +889.35 at 9065.12, Nasdaq +143.57 at 1649.47, S&P +91.59 at 940.51

[BRIEFING.COM] A volatile session gave stock market bulls something to cheer about, with the Dow surging 889 points on Tuesday, as bargain hunting and short-covering offset the weakest consumer confidence reading on record.

The S&P 500 rose 3.9% shortly after the opening bell, buoyed by strength in overseas markets. The index then fell to a loss of 0.4% due to the bearish consumer confidence news, only to rally into the close at session highs with a gain of 10.8%.

Strength was broad-based with all ten economic sectors posting a gain of at least 7.5%.

Retailers rallied 13.6%, with Target (TGT 38.44, +5.75) gaining 11.7%. Pershing Square Capital Management shared ideas with Target related to an alternative ownership structure of Target's real estate. The consumer discretionary sector rose 13.1%.

The energy sector rose 11.9%, lifted by better-than-expected results at Occidental Petroleum (OXY 49.77, +7.69) and Valero Energy (VLO 16.83, +1.72). The sector also received an indirect boost from BP (BP 45.52, +6.37), which posted stronger-than-expected earnings and revenue growth.

On a related note, the materials sector climbed 12.6%, aided by better-than-expected earnings at U.S. Steel (X 32.25, +4.43).

Boeing (BA 48.85, +6.49) climbed 15.3% after it reached a four-year tentative labor agreement with its striking machinists union. The union, Boeing's largest, has been on strike since the beginning of September due to disagreements on compensation, benefits and job security. The industrials sector rose 10.0%.

In overseas trading, Asian markets rallied with Japan's Nikkei closing up 6.4% and Hong Kong's Hang Seng surging 14.4%. European stocks rose 2.3%. Germany's DAX surged 11.3% as Volkswagen spiked 81.7%, marking a two-day gain of 348% due to a short-covering fueled rally after Porsche said it was increasing its stake in the automaker on Sunday.

The gains in Volkswagen sparked some volatility in the U.S. market, with Goldman Sachs (GS 94.59, +1.71) dropping as much as 11% on speculation that it was exposed to Volkswagen short positions. CNBC reported its sources at Goldman said the company had no significant losses related to Volkswagen. The financial sector rose 12.5%.

In economic news, it was expected that consumer confidence would fall in October given the recent market turmoil, but the severity of the decline was not anticipated. Specifically, consumer confidence plummeted 23.4 to 38.0 in October, according to the Conference Board's survey. This was worse than the expected reading of 52.0. It marks the lowest level on record, which dates back to 1967.

August home prices in 20 major metro areas fell 16.6% year-over-year, according to the S&P/Case-Shiller Index, which matched expectations. Home prices have fallen on a year-over-year basis for 20 straight months.

In currency trading, the dollar soared 4.1% against the yen after reports indicated that the Bank of Japan is considering cutting its benchmark interest rate to 0.25% from 0.50%.

..Nasdaq 100 +10.9%. ..S&P Midcap 400 +8.6%. ..Russell 2000 +7.6%.

Tuesday Day Trading: ES Final Trade $4,125.00 on 3 Contracts

Click on chart for final comments on the ES Market trade.

Click on chart for final comments on the ES Market trade.Entry at 2:30PM Eastern time ... Entry Price 877.50

1/3 Exit at 883.50 = $300

2/3 Exit at 891.50 = $700

3/3 Exit at 940.00 = $3125

Total on Trade for every 3 contracts was $4,125.00. Total for every 2 contracts traded was $1000. This was a very nice trade to close the month of October for me. I have found the last few days at the end of the month not so healthy for my account.

I will be taking off the rest of the month, and most likely will not trade again until after the election now. I reserve the right to change my mind, but I will not trade again in the month of October now.

Once again, today's total on the trade for every 3 contracts traded was $4,125.00.

Good Trades,

David AKA Tiger

Tuesday Day Trading: Long ES Trade

Click on chart for comments on the ES Market Trade. This trade is still open with one contract trailing on the greenline, exit will be on the greenline or 4PM Eastern time, which ever comes first.

Click on chart for comments on the ES Market Trade. This trade is still open with one contract trailing on the greenline, exit will be on the greenline or 4PM Eastern time, which ever comes first.Right now this trade has already realized $1000 in trading profits, and one contract is still open, that will add to this overall profit.

Be back with the final results in a bit.

Good Trades,

David AKA Tiger

Monday, October 27, 2008

Monday Day Trading: ES Short Trade

Click on chart for comments on the ES Market trade. This was my 2nd attempt to get short this afternoon. My first trade at 3PM did not work out, but the second one went to target and the last contract came off at 4PM Eastern time. Second entry time was 3:45PM and was in the trade for 15 minutes with a tight stop on the trade.

Click on chart for comments on the ES Market trade. This was my 2nd attempt to get short this afternoon. My first trade at 3PM did not work out, but the second one went to target and the last contract came off at 4PM Eastern time. Second entry time was 3:45PM and was in the trade for 15 minutes with a tight stop on the trade.Good Trades,

David AKA Tiger

Saturday, October 25, 2008

Thursday, October 23, 2008

Wednesday, October 22, 2008

Wednesday Day Trading: ZB Long Final Trade Details

Final Trade Details:

Entry at 1:35PM Eastern time at 115^22

1/2 Profit Target at 115^30 = $250

2/2 Profit Protective Stop at 115^31 = $281.25

Total on Trade for every 2 contracts traded was $531.25, before

commission costs. Just so you know I pay $5 per round turn on the

ES and ZB.

So the net gain on trade was less $10 for every two contracts or

$521.25 today.

I will be placing the final trade on my blog today, but y'all saw

it first!

In any case, I have decided for now we will have a trade of the

week, since I do a video of the week, etc.

I want to wish you all the best in your trading, and as always, if

I can ever be of assistance please let me know.

On a final note, I will be placing another educational video on the

training blog this week called: www.DayTradingKnight.com

That's All Folks have a great rest of the week!

Good Trades,

David AKA Tiger

Current ZB Trade Updated Chart 1/2 Off at 115^30 for $250

Click on chart for continued comments on the trade. New stop set at 115^24 looking for 116^10 on move up. This trade will close out at 2:50PM Eastern time, if not hit.

Click on chart for continued comments on the trade. New stop set at 115^24 looking for 116^10 on move up. This trade will close out at 2:50PM Eastern time, if not hit.My trading plan will look to move my protective stop closer to market action as we get closer to closing time in the bonds. This trade is in the long bond or the 30 year treasury.

Good Trades,

David AKA Tiger

Wednesday Day Trading: Trade of the Week EMAILED to List

Wednesday Day Trading: ZB Short Trade

Tuesday, October 21, 2008

Tuesday Day Trading: ZB 2 Long Trades $1,281.25 per 2 Contracts

Click on chart for comments on the ZB Market trade today.

Click on chart for comments on the ZB Market trade today.There were 2 different trades today. First one made $500, and the second one made $781.25 on every 2 contracts traded. Today, I would like to comment on one over the other. The first trade took it's sweet time getting to the profit target, and on a pullback took out the second contract.

I, personally like to see a quick move to the profit target like in the second trade. The second trade made the profit target in one bar, and the average daily range high was also taken out before any pullback came into play.

As you can see, the second trade was stronger and had more pull than the first one. This is a good case of how momentum can work for you while you are in a trade, and in this case it was able to carry you to the average daily range high.

I placed my long profit stop at 115^08, but I was toying with that number and 115^10. In the end, I went with an exit of 115^08.

One note, if you were trading 3 contracts or a series of 3, there was an opportunity to trade on the greenline and exit on the 3rd contract at 115^06. Today, I made the decision to only trade the 2 contract series and not the 3 contract series.

My thoughts are ... I have made a lot of money in September and October, and more importantly, I want to take it with me and not give it back.

Good Trades,

David AKA Tiger

P.S. I saw no trades early yesterday, and I took my kids to the ZOO. Another key to being a day trader is being able to take time to smell the roses. Just my humble 2 cent opinion on trading here.

Friday, October 17, 2008

Thursday, October 16, 2008

Thursday Day Trading: ES Long Breakout Final $3800

Click on Chart for comments on the ES market trade.

Click on Chart for comments on the ES market trade.Total on Trade was $3,800.00. This market right now is smoking hot. With that being said, I will not be trading tomorrow on Options Expiration day, and also it is Friday. This was another very good week.

It is still absolutely amazing how far the market is going back and forth on extreme wild swings. Remember to "Trade What You SEE, NOT What You THINK!"

This trade was one that I entered on a series of 3 contracts today at 903.50. The trade setup was a BREAKOUT out of a TRADING RANGE. I took 2 contracts off at my first target which was 8 points from my entry at 911.50 for $400 for each contract or $800 for 2 contracts.

At the end of that entry bar, I went in LONG once again on 2 with a LIMIT ORDER at 911.50, and I still had my original contract back at 903.50 going for me. My next target was once again 8 points from the entry of 911.50 to 919.50 for another $800 as once again I took off the 2 contracts.

At this point in time, I did not add to my trade any more, as I was sitting on $1600 worth of gains, and 1 contract running. The target I choose was based on the ADR, in this case the UPPER Daily Range of 950.50. I placed it 3 points under that target at 947.50, and this last contract was taken out of the market at target before my 4PM Deadline.

The last contract earned $2,200 plus the $1,600 from before for a total of $3,800.00 on this trade. My protective stop movement went from 919.50, to 921.50, to 937.50 on the last bar to protect unrealized profits.

All in all, a very nice trending trade.

Good Trades,

David AKA Tiger

Thursday Day Trading: ES Long Breakout Trade

Click on chart for comments on the ES Market Trade. I am looking for a Long Target of 947.50 today. We have had some wild swings and the ADR (Upper Daily Range) has it within range today so why not!

Click on chart for comments on the ES Market Trade. I am looking for a Long Target of 947.50 today. We have had some wild swings and the ADR (Upper Daily Range) has it within range today so why not!Entry 903.50 on 3 Contracts

Took 2 off at 911.50 = $800

Added 2 at 911.50 again

Took 2 off at 919.50 = $800

One Contract is currently running with a Protective stop at 919.50.

Exit is at Target of 947.50, 4PM Eastern Time Time Stop, Greenline Exit, or Stop Loss of 919.50, whichever is hit first as the trade develops.

Good Trades,

David AKA Tiger

Wednesday, October 15, 2008

S&P 500 Plunges Most Since Black Monday 1987

S&P 500 Plunges Most Since Black Monday

Dow -733.08 at 8577.91, Nasdaq -150.68 at 1628.33, S&P -90.17 at 907.84

[BRIEFING.COM] The stock market plunged the most since the crash of 1987 as disappointing retail sales data and credit concerns renewed economic fears. Specifically, the S&P 500 plunged 9.0%, settling near session lows.

Consumers continue to curtail spending in the face of economic headwinds. Retail sales in September tumbled 1.2% month-over-month, the third consecutive monthly drop and largest decline in three years. The decrease was larger than the expected drop of 0.7%. Sales are down 1.0% compared to last year, marking the first year-over-year decline since October 2002.

Separately, the Producer Price Index, an inflation reading, fell 0.4% in September due to a decrease in commodity prices. Excluding food and energy, PPI rose 0.4%, which was more than the expected increase of 0.2%.

Although credit markets are showing signs of improvement, there are concerns that a recovery will take longer than hoped for. Dollar Libor, which is the rate banks charge each other for short-term dollar loans, slightly declined across all terms for the second straight session, but remain at highly elevated states. This indicates banks are more willing to lend to each other, but are still showing extreme caution. In addition, there was a high demand for Treasuries as investors seek safety.

An afternoon speech from Fed Chairman Bernanke and the release of the Fed's Beige Book did not give the market any real surprises, but painted a sobering economic picture and indicated that a recovery will take time.

Economic concerns sparked broad-based selling, with 99% of the S&P 500 posting a loss and all ten of the economic sectors ending the day deep in the red.

The energy sector (-15.5%) was hit the hardest, falling in conjunction with energy commodities. Crude prices tumbled 5.9% to $74.03 per barrel on global slowdown concerns and a cut in OPEC's demand forecast. On a similar note, commodity prices as a whole fell 4.5%, resulting in a 12.1% decline in the materials sector.

Defensive oriented sectors consumer staples (-6.0%) and healthcare (-6.7%) outperformed on a relative basis, but still posted steep declines.

In earnings news, quarterly results were mostly better than expected, although several companies that posted upside results still came under selling pressure.

Some of the more notable names that topped expectations include Abbott Labs (ABT 53.40, -1.38) Coca-Cola (KO 44.19. +0.46), Intel (INTC 15.05, +0.88), JPMorgan Chase (JPM 38.34, -2.37) and Wells Fargo (WFC 32.76, -0.76).

The S&P 500 is now up only 1.0% this week after giving up the majority of Monday's massive 11.6% gain. The index is still up 8.1% from its multi-year intraday low reached last Friday.

..Nasdaq 100 -8.8%. ..S&P Midcap 400 -9.7%. ..Russell 2000 -9.5%.

Tuesday, October 14, 2008

Video of the Week: Happy Trails by Van Halen

To that special person out there, you know who you are. :-)

Good Trades and Happy Trails,

David AKA Tiger

Tuesday Day Trading: ES Spike Reversal Short Trade

Click on chart for comments on the ES Market trade.

Click on chart for comments on the ES Market trade.Entry at 9:45AM, entry price 1038.25

1/2 Exit at 1032.25 = $300

2/2 Exit at 1019.50 = $937.50 (Close Gap)

Total for every 2 contracts = $1,237.50

This trade went for the GAP. The high of the market from yesterday was 1017.50. I placed a longer term target of 1019.50, which was hit quickly this morning. I am still trading 6 point profit target and a 4 point stop loss on my bracket order when I got into the market.

My thought process was to trade what the market is showing. This morning it was pretty obvious that the market wanted to try to go to the GAP. I reduced my contract size today, and only took on 2 contract size for this trade.

This turned out to be a decent trade. On a side note, my ZB market data is off today, but my ES data is not. I will not be trading any more today based on my gain this morning.

Good Trades,

David AKA Tiger