Friday, December 9, 2011

Wednesday, December 7, 2011

December 7th, 2011: A Nice Comeback Trading Day Today

Hello Traders,

Hello Traders,David 'Tiger' Knight

Tuesday, December 6, 2011

Beware PROS at WORK!

Pro Money at Work! This is what I was fighting on my short!

Monday, December 5, 2011

Could this be a Coincidence? I THINK NOT!!

There is nothing wrong with your trading strategy. What this means, is you are either wrong in the timing of the trade, or simply wrong about your trading decision. More times than not, you will find yourself on the wrong side of the trade, because your timing was off, than simply wrong about the direction of the overall trend.

The market has a way of doing whatever it wants to do. What we can do as traders is simply go with the overall odds, and keep us in the game. We never want to risk everything we have on any given trade.

As a small account trader, your number one job is always the same … it’s about SURVIVAL! Did I trade poorly today? Was I the GREATER FOOL? Why?

The market operates under the premise of the GREATER FOOL theory. Any financial instrument is only worth what a person is willing to pay for it, or lack thereof. As I think about my trading today, where I was able to trade 2 contracts, but lost on both trades to the tune of $1,604. What made me think for any part of the day that I was smarter than the market?

Terms from Richard Wyckoff … Jumping the CREEK and Coming Back to ICE! I NEED to be aware at all times as a day trader to determine the CREEK and where to determine the ICE! This is a trading concept that will not take any more of my money. I should have a tight stop in place when the market is breaking out to NEW HIGHS or NEW LOWS.

I need to make sure and determine for my own eyes the market is making HIGHER HIGHS for a LONG position. On the contrary, I need to determine with my own eyes the market is making LOWER LOWS for a SHORT position.

If the market is in the middle, then I should have my stop a lot closer to the market. I had a lot of time to get out of the market today at the 102.17 level after it failed, and I should not have entered again as it was approaching the CREEK … in this case the CREEK was the Previous Day High … that could have become ICE if held … or simply a barrier to LOWER PRICES if it did not HOLD.

Today I was the GREATER FOOL! Never again will this happen in my trading!!

Good Trading,

David 'Tiger' Knight

Saturday, December 3, 2011

Monday, November 28, 2011

November 28th, 2011: Low Eminent in Crude Oil?

Wednesday, November 23, 2011

November 23rd, 2011: Crude Oil Back to the Daily 200 Bar Moving Average!

Tuesday, November 22, 2011

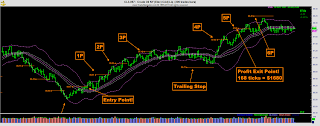

November 22nd, 2011: Nice Afternoon Trading in Crude Oil

Saturday, November 19, 2011

Thursday, November 17, 2011

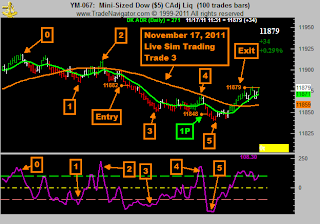

November 17th, 2011: eMini Bull Bear Foundational Trading Strategy is Introduced

David 'Tiger' Knight

Friday, November 11, 2011

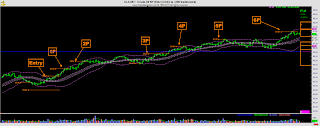

Long Signal with Ascending Triangle Formation

Thursday, November 10, 2011

Question: I want to make $6,000 per month Trading!

November 9th, 2011: Nice Trading Day in Crude Oil

What are my thoughts on trading over the years?

Good Continued Trading,

David 'Tiger' Knight

Monday, November 7, 2011

Friday, November 4, 2011

Thursday, November 3, 2011

Wednesday, November 2, 2011

November 2nd, 2011: Nice afternoon trade after FOMC/Fed Funds Rates

Monday, October 31, 2011

Tuesday, October 18, 2011

October 18th, 2011: 300 Trades Chart

October 18th, 2011: Nice VSA Setup - Shakeout Bar!

Thursday, October 13, 2011

October 13th, 2011: Crude Oil Double Bottom Appears and Up We GO!

Tuesday, October 11, 2011

Will we see $97 Crude Oil Now?

Friday, October 7, 2011

Tuesday, October 4, 2011

October 4th, 2011: Finally Some Action Up and Down in Crude Oil!

Friday, September 30, 2011

Wednesday, September 28, 2011

Friday, September 23, 2011

September 22nd, 2011: Yesterday's Short in Crude Oil

Wednesday, September 21, 2011

September 21st, 2011: Nice Short Trading Opportunity in Crude Oil Today

Knight Capital Management

Knight Capital ManagementTuesday, September 20, 2011

Monday, September 19, 2011

Friday, September 16, 2011

Interesting Trade on Crude Oil Options Expiration Day

Thursday, September 15, 2011

Wednesday, September 14, 2011

Thursday, September 8, 2011

Thursday, September 1, 2011

The KING still has ONE more MOVE!

http://KnightCapitalManagement.com

http://KnightCapitalManagement.com

I was reading in the book from Zig Ziglar called "See You at the Top," about a chess match between a man and the devil. The name of the painting is called "Checkmate." In this chess match the devil has just announced checkmate and is sitting there all smug and confident in his apparent win.

Billy Graham told a story about this particular scene during one of his Christian Crusades ... a reputed chess master, I believe of the name of Paul Mercer studied this painting and came to the conclusion this chess game is not over ... he went on to say the KING still has ONE more MOVE!

The game is never ever over until you allow it to be over ... place your trust and confidence in God ... He has said He will always allow for an escape to those that come to HIM.

Good Trading,

David "Tiger" Knight

Monday, August 29, 2011

Wednesday, August 24, 2011

Tuesday, August 16, 2011

Today's trading showed a couple nice long entries

Monday, August 15, 2011

Nice Trade for a Monday

http://KnightCapitalManagement.com

Today showed a nice entry at 9:05AM Eastern time today and a nice run up to the previous day high (Friday) before any real retracement on the trading day.

Overall, a very nice signal and trade.

Good Trading,

David "Tiger" Knight

Wednesday, August 10, 2011

Tuesday, August 9, 2011

Monday, August 8, 2011

Tuesday, August 2, 2011

Monday, August 1, 2011

Could you have predicted a downward break on this chart before August 1st?

Tuesday, July 26, 2011

Wednesday, July 20, 2011

Tuesday, July 19, 2011

Friday, July 15, 2011

Tuesday, July 12, 2011

NEW Live Tiger Trading Room YouTube Video

Thursday, June 23, 2011

Wednesday, June 8, 2011

Monday, May 23, 2011

Win at all costs ... really???

Tuesday, May 17, 2011

The Evil Speculator Strikes Again!

http://KnightCapitalManagement.com

Sign Up on Left for more Free Information!

Good Trading,

David "Tiger" Knight

Monday, May 9, 2011

Tuesday, May 3, 2011

Thursday, April 28, 2011

Monday, April 25, 2011

Don't Blame the Speculators ...

Why are oil speculators being singled out when every commodity on the globe (except for our abundantly supplied natural gas market) is exploding? If energy speculators are to blame for running up prices, then why then are they leaving natural gas alone? Perhaps it is because we have plenty of supply and it is a domestically traded market that is less susceptible to the value of the dollar overseas.

Yet the president does have a magic bullet to bring down prices. It is called the budget. If President Obama can get spending under control, then the value of the dollar would increase and the price of oil would fall. Just look at what happened to the price of oil and the value of the dollar when Standards & Poor's lowered the outlook on U.S. debt. The day of the downgrade on the U.S. outlook on April 18, 2011, the June dollar index hit a high of approximately 76.05 before it retreated ignominiously to a low of around 73.93 on April 22, 2011. The price of oil hit a low of approximately 106.54 on the day of the downgrade and now has surged to as high as the 113.07 area overnight.

Deficits do matter and they cost all of us. The other silver bullet for gas prices remain with the Federal Reserve. The Federal Reserve with QE2 has dramatically increased the price of oil. In August of 2010 oil was as low as approximately 70.76 and now, as the QE2 comes to a close, we see oil hitting about $113.00 a barrel. QE2 drove investment and demand in the emerging markets. The price of Brent crude in august of 2010 was as low as approximately 74.64 and now has soared trading as high as around s$127 plus. In his historic Fed press conference this week, Ben Bernanke will have to explain why this has happened. My bet is that he won't have a good answer.

David "Tiger" Knight

Sunday, April 17, 2011

Where is Barney Frank on this?

Are people simply IGNORANT?

Some Statistics about Poker Players ...

Statistics about Poker in the U.S.

from Topline Findings: “The Topline Findings shown below are examples from an earlier study conducted in January 2007 which was based, as are all our surveys, on a representative sample of over 13,000 regular poker players playing at least once a month across the U.S., Canada and Western Europe.”OVERALL

- 40 million people play poker regularly (6.8% of the adult population)

- 23 million of these regular players are in the U.S. (10.1% of the U.S. adult pop.)

- 15 million in total play online for real money (2.6% of the adult pop.)

- 7 million play online for real money at least once a month (1.4%)

- 5 million play for real money at least once a month in “Home Games” (1.1%)

- 2 million play for real money at least once a month in “Private Clubs” (0.4%)

- 10 million have played in a casino in the last year (1.6%)

- Of the 15 million online money players, 76% are male

- Of the 15 million online money players, 58% are under 35 years of age

Americans - Stand Up and Fight! Enough is Enough!

http://tinyurl.com/5grjua

It's time to let your congress, state and national know that you will not stand quietly while this goes on.

If the government can get away with this, it won't be long until they start their attack and bombardment on traders.

We are also considered by many "a game of skill" ... don't fool yourself and allow the same thing to happen to your livelihood. I am only a casual online poker player, and not that good to boot, but what they are doing is simply wrong.

To shut down websites ... when these companies would be more than happy to have an arrangement to pay taxes is total bozo type of romper room action!

http://tinyurl.com/5grjua

Nobody gets paid when the government steps in ... money magically disappears and if you are able to get anything it is pennies on the dollar. One of my "investments" that was seized by the government still has not paid me my money back now going on over 10 years.

Don't fool yourself ... this is a declaration of war against USA internet poker players. They have decided to shut down 3 major companies ... these companies have already moved to not allow USA player to play for real money.

The government by playing hard ball has lost before they have started. Obviously, there are bigger things a foot ... but if poker players all over the USA don't mind paying their fair share of taxes ... this is revenue that is much needed in America!

Is this the land of the (how do you say this word without is showing up as spam) how about freedom, but take the last three letters away or dom.

This is simply outrageous, and what is next ... they go after our GUNS? You may no longer have a gun if you live in the USA ... you may no longer hunt ... you may no longer fish ...

http://tinyurl.com/5grjua

Where does it stop? When will Uncle Sam awake and decide enough is enough!!!

WE are under attack ... you can bet on this ... if they can get away with this then the next attack will be at day trading ... you can take that to the bank!

Day trading is "a game of skill". We need to protect our poker playing brethren today ... stand up with them and fight for the right to have the government stay the HELL out of our life.

They may have our taxes, but stay out of our lives ... quit dictating to us what is good and what is bad. That is our job as man and women, parents, etc. to determine not the government.

IF they simply wanted to go after the people they could have done this without shutting down the websites in the USA.

Have you even seen what they did? Go to either:

http://fulltiltpoker.com

http://pokerstars.com

http://absolutepoker.com

These are the 3 of the biggest online companies in the world. Full Tilt in 2006 moved their operation from the USA to Ireland. Do they really believe they can go across National Country lines ... if they would simply legalize it and allow it ... then money would flow in.

Does prohibition ever work? Has it ever? How do you get more taxes from people as a whole? By taxing them more, or lowering the taxes and allowing business's to flourish?

You know my answer to that ... lower taxes and more money will flow it has been proven over and over. Make America a country that companies want to do business in ... not the other way around!

This is truly a war that we have to WIN! We cannot allow the government to continue to bankrupt our beloved USA into oblivion. We need to stand up, unite, for our fellow poker players, our children, and our grandchildren.

The USA is under attack ... make no qualms about it ... our individual liberty is at stake here. I am not calling for people to get there guns ... don't think that is what I am saying ... but it is time to stop the insanity!!!

STOP THE INSANITY!!!

Seriously, where does this make sense! If you spend more than you take in ... Economics 101 ... what is the answer to what happens to you? DING DING ... you got it BANKRUPT!

http://tinyurl.com/5grjua

How do you stop going bankrupt? AH, let me see ... if I make more than I spend .... hmmm ... then I should have more left over ... duh!!

Can you tell I am a little pissed off ... I even waited 48 hours before I decided to take a stand ...

We are under attack ... our way of life and livelihood is under a barrage of legalism! This is not the way that I want our country to go or head!

These are not drug lords ... yeah ... but they disgused their payments you say ... well ... if you would simply LEGALIZE it then duh they wouldn't have to DISGUISE the way the have to pay people.

MAKE IT LEGAL! How hard is that to do!

http://tinyurl.com/5grjua

Stop the INSANITY!!

Sincerely,

David "Tiger" Knight

P.S. Want to do something about it and write the president, senate, and congress? Go here and join the PPA: http://theppa.org/

Grassroots baby! Let's show what community organization is all about!!

Tuesday, April 5, 2011

Friday, April 1, 2011

Welcome to April! Nice Win to Start the Month Off.

Monday, March 14, 2011

Wednesday, March 2, 2011

March 2nd, 2011: Classic VSA Long Setup - TCB Crude Oil Trading Strategy

http://KnightCapitalManagement.com

Today was a very interesting trading session after the Crude Oil Inventory Report.

Good Trading,

David "Tiger" Knight

Wednesday, February 23, 2011

Crude Oil gets close to $100 per barrel and backs off ...

David "Tiger" Knight

Friday, February 11, 2011

Egypt President Steps Down ... Quick moving market

Then the news comes out ... and presto whamo ... you could have been under a ton of money quickly. We were able to pull out 10 ticks on the move up before the free fall ... was it luck or time of day ... or simply our plan.

Wednesday, January 26, 2011

TCB Crude Oil Trading Strategy Results - Jan 2011

http://www.knightcapitalmanagement.com/tcb

Learn how to day trade futures with Tiger of Knight Capital Management. Our last video series showcases the Top 10 Most Frequently Asked Questions (FAQ) received from traders about how to day trade futures the right way.

Have you looked into our newest product in Crude Oil called TCB?

More Info:

http://www.knightcapitalmanagement.com

Twitter: http://twitter.com/tradecraze

FaceBook: http://www.facebook.com/tradecraze

Good Trading,

David "Tiger" Knight