Volume and CCI

(next video: Putting It All Together)

Good Trading,

David "Tiger" Knight

Volume and CCI

(next video: Putting It All Together)

Good Trading,

David "Tiger" Knight

CCI Part 2 and Volume Part 1

Good Trading,

David "Tiger" Knight

ADR - Average Daily Range

CCI - Commodity Channel Index

Good Trading,

David "Tiger" Knight

(make sure to press fullscreen to see the video better)

Enjoy ... another good day of trading in the Tiger Trading Room.

Good Trading,

David "Tiger" Knight

Trends and Countertrends plus Major and Minor Support and Resistance

Good Trading,

David "Tiger" Knight

We are halfway through the eMini Bull Bear Basic Free Method now.

Happy Holidays,

David "Tiger" Knight

Click on chart for a larger image of the eMini S&P (ES) trade.

Click on chart for a larger image of the eMini S&P (ES) trade.eMini Bull Bear Basic Free Method: Uptrend and Downtrend Defined

On this video we use colored bars to help in our decision process, and start to put a trading strategy together. We will continue to build on this during December.

Good Trading,

David "Tiger" Knight

eMini Bull Bear Basic Free Trading Method

On the previous video, I alluded to a "free" method or a stripped down version of the eMini Bull Bear Method called for lack of a better term the eMini Bull Bear Basic Free Method.

This is a method that has the small account trader in mind as I went about and put it together. On average, to day trade in the ES a person needs at least $500.00 USD in there trading account. Although, I recommend a starting account balance of at least $5,000.00 USD.

At the heart of this method, "free" one is to allow the individual trader/investor a valid way to earn while they learn to trade the eMini S&P. This free method is a strategy that includes only trading one contract per trade.

In other words, this basic strategy does not include the "kitchen sink" like trading multiple contracts, and trading account leverage. But it is a valid method to attack the eMini S&P profitably allowing the individual trader/investor to build their own account and more importantly gain confidence in trading the futures market.

If you want further details on this basic method, send an email to support@knightcapitalmanagement.com and I would be happy to get back in touch with you with details as I continue to put this method together.

Look for more video content on either my blog or youtube, and eventually on my main website home at www.KnightCapitalManagement.com

Good Trading,

David "Tiger" Knight

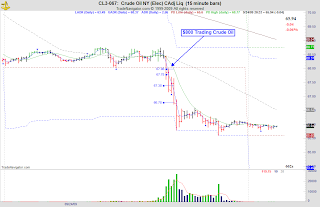

Click on chart for a larger image of the Crude Oil (CL) trade.

Click on chart for a larger image of the Crude Oil (CL) trade. Click on chart for a larger image of the Crude Oil (CL) short trade.

Click on chart for a larger image of the Crude Oil (CL) short trade. Click on chart for a larger image of the eMini S&P (ES) trade.

Click on chart for a larger image of the eMini S&P (ES) trade.

Click on chart for a larger image of the Crude Oil trade considered today.

Click on chart for a larger image of the Crude Oil trade considered today. Click on chart for a larger image of the eMini S&P (ES) market.

Click on chart for a larger image of the eMini S&P (ES) market.

Click on chart for a larger image of the Crude Oil (CL) market trade.

Click on chart for a larger image of the Crude Oil (CL) market trade. Click on chart for a larger image of the Gold (GC) Trade.

Click on chart for a larger image of the Gold (GC) Trade. Click on chart for a larger image of the eMini S&P day trade. 3 point target with a 2 point stop today in the afternoon.

Click on chart for a larger image of the eMini S&P day trade. 3 point target with a 2 point stop today in the afternoon. Click on image of the trade for a larger picture of the Crude Oil trade taken today.

Click on image of the trade for a larger picture of the Crude Oil trade taken today. One week early, but the reentry trade on the 5 minute or the 15 minute time frame after the FOMC announcement gave an excellent opportunity to put this trade in the ES back on this week.

One week early, but the reentry trade on the 5 minute or the 15 minute time frame after the FOMC announcement gave an excellent opportunity to put this trade in the ES back on this week. Click on image of eMini Short Positional Seasonal Trade in the eMini S&P.

Click on image of eMini Short Positional Seasonal Trade in the eMini S&P. Click on chart for a larger image of the eMini Spike Reversal trade.

Click on chart for a larger image of the eMini Spike Reversal trade. Click on image for a larger picture of the Crude Oil Trade from this week.

Click on image for a larger picture of the Crude Oil Trade from this week. Click on chart for a larger image of the ZN (10 year Note) Market trade.

Click on chart for a larger image of the ZN (10 year Note) Market trade. Click on chart for a larger image of the Soybean Market trade.

Click on chart for a larger image of the Soybean Market trade. Click on Image for a larger picture of today's trade in the Gold Market. Patience pays off big time today!!

Click on Image for a larger picture of today's trade in the Gold Market. Patience pays off big time today!! Click on image for a larger picture of the eMini (ES) Market.

Click on image for a larger picture of the eMini (ES) Market. Click on image for a larger picture of the Crude Oil Market Chart.

Click on image for a larger picture of the Crude Oil Market Chart.